Conspiracy: The US Dollar is in secular decline and stands to be replaced as the world’s reserve currency.

“The tales of my demise are greatly exaggerated.” – Mark Twain.

Few quotes capture the situation as accurately as Mark Twain’s famous quip when it comes to the recurring predictions of the dollar’s demise. Whether it be from the threat of Crypto, Quantitative Easing, or the decline of the Petro-Dollar (the US Dollar’s wide use for the trade of oil), academics, despots, and political commentators alike have been predicting the end of the dollar for nearly a generation.

Truth Serum: It is true that there has been an increase in non-dollar-denominated trade in recent years.

Specifically, these agreements are generally bilateral. For example, China and Brazil agreed to trade in Yuan and Real (their currencies) for trade between the two. HOWEVER, in virtually all instances of more than bilateral trade, OR when it doesn’t make sense for the trading countries to use their own currencies, the US Dollar is far and away the most desirable currency for trade.

While I will address the risks to the dollar reserve system later in this post, it is important to understand WHY the dollar is so prominent:

- America makes up 24% of the global economy (Visual Capitalist)

- America has the longest history of strong Property Rights and adherence to the Rule of Law.

- America is a democracy (representative republic for those desiring to be precise)

These three items play together to create the strength of the US Dollar Trading System we’ve enjoyed for the past number of decades. Due to the significant economic activity generated by the US, there is a constant demand for dollars. Because the US has a track record of respecting the ownership of assets and validity of contracts, countries generally don’t have to worry about being taken advantage of by the US. Finally, because of our rule by the people and, just as importantly, the separation of powers, the US system is stable relative to nearly all other options.

Examining the other currencies available for trade makes this reality all the more straightforward.

The Euro has never caught on as a replacement for the dollar. The EU is just as guilty as the US of running structural deficits, some individual nations are economically vulnerable (Italy and Greece, among others), and while France and Germany create a strong backbone for the trading bloc, they do not have the stability of their system that America does even on its worst day.

Scoreboard!

In a game of pick-up basketball or a video game match between friends, a common refrain to stop the trash talk of another is to shout, “Scoreboard!” Essentially saying… look I hear what you’re saying, but the scoreboard shows I won, so that’s enough.

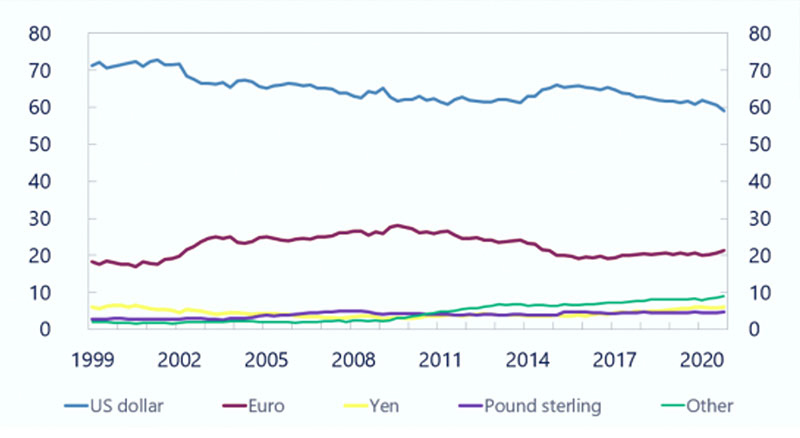

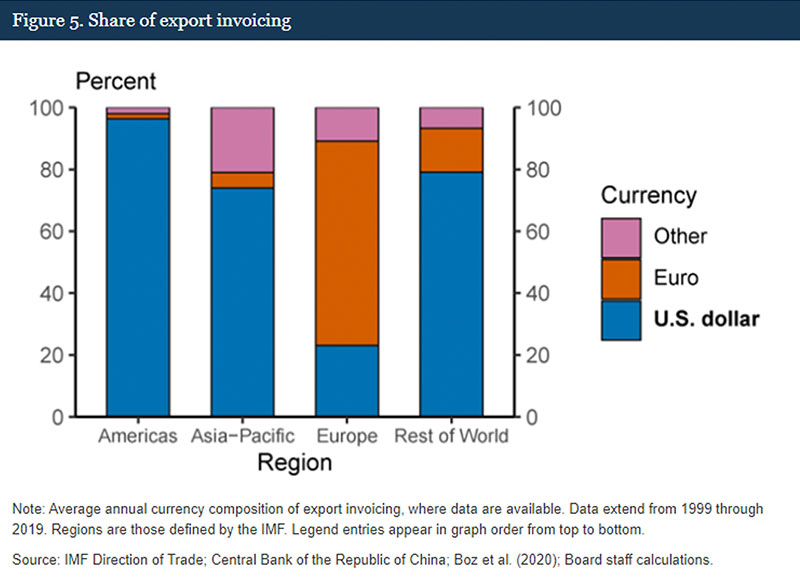

On this topic, the “Scoreboard” moment is to look at the composition of Foreign Reserves as well as the denomination of trade among currencies over time.

Both charts above highlight that the plurality of trade and reserves still run through the US Dollar system. While it is not guaranteed to stay this way forever, and policymakers should be careful when taking steps that may harm it, the US Dollar isn’t going anywhere soon.

When it matters: So, if the dollar isn’t at risk now, when should we be worried?

The following are what I believe to be scenarios where the dollar might see renewed pressure:

The relative size of the US Economy shrinks meaningfully

More countries align themselves with Russia, North Korea, Iran et al.

The US weaponizes financial sanctions improperly

The US compromises its long-term adherence to the Rule of Law.

The US budget becomes structurally unsound, meaningfully worse than other developed nations (Japan, EU, ETC..)

As the intro to the Contrary to Commentary series references, the purpose of these pieces is to highlight the shades of grey that make up our economic system and financial markets. Nowhere is that more prevalent than in items 3 and 4 above.

As an example, consider the ongoing War in the Ukraine.

The US took a significant risk when it froze assets and rolled out one of the most penalizing financial sanctions packages for Russia after the Invasion of Ukraine in early 2022. How that set of sanctions evolves is important for the Dollar system. Specifically, what line would another country have to cross for the US to rerun this playbook? What would China have to do to see similar treatment? Are frozen Russian Assets preserved to be turned back over in the future? Respecting the rule of law has historically been the approach of the American Government, and I think important for it to continue to be.

As it stands right now, the only nations actively seeking non-dollar trade options are those that stand in long-term opposition to the American way of life; primarily China, Russia, and the Despot States of Iran, North Korea, etc., and it’s important to keep it that way. With the proper respect for why the “Mighty Dollar” rose to power, there’s no reason to believe it can’t maintain its power for decades, if not generations to come…. And as referenced at the outset, the tales of the Dollars Death have been greatly exaggerated in this author’s opinion.

June 2023