“The pace of change has never been this fast, yet it will never be this slow again” – Canadian Prime Minister Justin Trudeau, 2018 at the World Economic Forum

As human beings it is out natural inclination to view life and progress through a “linear” or “stable” lens, seeing a slow march toward improvements, however the true power of technology is actually “exponential” growth. Taking away the “math geek” verbiage, what this means is that the powerful technology around us is not only constantly improving, but the rate at which its increasing is also speeding up!

This has large implications for the financial markets as both established mature businesses and newer growth companies are forced to reckon with a fast changing environment. This backdrop led to the Wall Street Journal article in 2018 with the headline “Every Company is Now a Tech Company” – WSJ 12/4/18

For any avid book reader desiring to explore this topic more in-depth, I’d highly suggest reading Matt Ridley’s book “The Rational Optimist”.

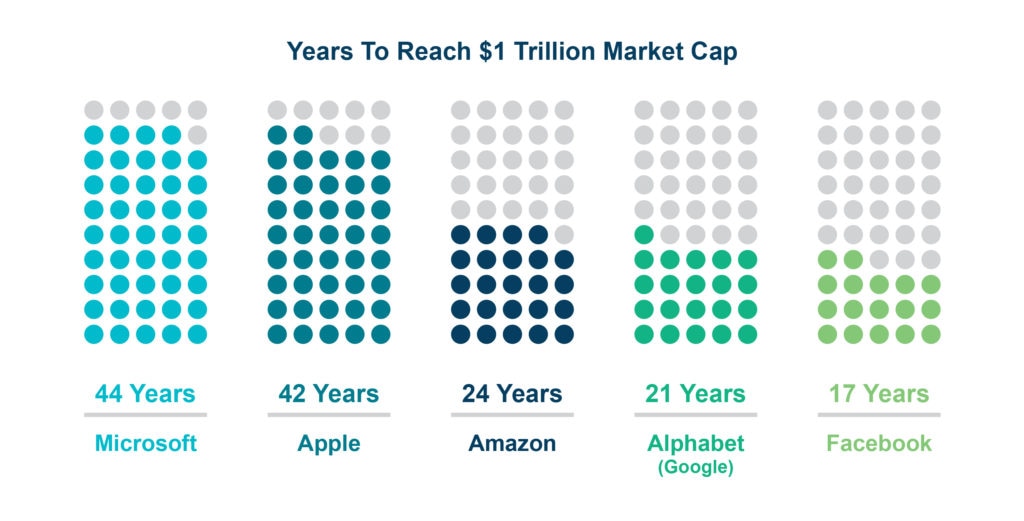

This dynamic in exponential growth is also shown in the speed with which companies are reaching large market caps. As more and more companies embrace the digital world, many of the barriers that made growth slow have gone away. Building a national rail road takes a long time, building and rolling out an international software company can be done in an impressively short time (while still being difficult!)

Perfectly showcasing this dynamic is the news that on June 28th, 2021 Facebook became the fifth US Company with a Market Cap of at least $1 Trillion Dollars, becoming the quickest company to do so.

These powerful trends are the reason we began managing our Innovative Growth Portfolio Individual Stock Strategy for clients at the beginning of this year.

The exponential growth in the end markets for businesses in Financials, Software, E-Commerce, Big Data, and Artificial Intelligence, provide what we believe to be a great backdrop for investing in companies.

Despite this powerful backdrop, there is no “Free lunch” in investing, and investors in this area certainly require a long-term view and the ability to withstand volatility. While we are unable to report returns of our portfolio given the differences in timing for each client, we encourage you to view your online access or give us a call to discuss the specific returns of our strategy.

After bottoming in the early to mid-2nd quarter, we have seen growth stocks resume their leadership as more investors have embraced the idea that higher inflation may be transitory, and the growth of many “Covid winners” may persist longer than many thought.

It is our goal in this strategy to own “the companies of tomorrow” combining the research to identify stocks with significant runways of growth, the patience to own through volatility, and the discernment to know when to make changes. A large task, but one we feel our investment committee is up to the challenge.

Finally, we have included below a few headlines from this quarter that caught our eye from companies we research within the space:

RH Reports Record First Quarter Results and Raises Fiscal 2021 Outlook

Docusign sees First Quarter 2021 Revenue increase 58% year-over-year

Palantir Forecasts Annual Revenue Growth of 30% or greater for 2021 through 2025

Facebook Reaches $1 Trillion Market Cap

July 2021