Despite only being half way over, 2020 has firmly placed itself in the record books in many ways.

Throughout these unprecedented times, our robust investment process remains unaltered; including bi-weekly (now virtual through WebEx) Investment Committee meetings, Company Earnings Calls, and Manager Due-Diligence Meetings. We remain as passionate as ever about pursing risk-adjusted tax efficient returns on your behalf.

With so much changing constantly, we wanted to provide an update on a few measures we’re watching in the market, and a few areas where we’ve been making changes to portfolios.

Portfolio Updates

With the short-term remaining exceptionally uncertain, we have continued to be consistent in our recommendations to prudently raise cash where there are cash needs between now and year-end. This continues to be the case today as markets have rallied significantly from the March lows.

Longer Term, we are optimistic on stock market returns as the recovery has been uneven. We believe there will be positive returns to be earned in cyclical stocks with good balance sheets as many in the markets have piled into the “Stay at Home” trade of Tech and Consumer Staples. Some growth stocks are beginning to look expensive, however company performance has largely improved in line with price. Compared to the mania in the late 90’s, the rally in Tech and Growth is still “early innings”

This uneven return in the second quarter has led us to make several adjustments to the portfolios we manage on a discretionary basis. These include:

• Adding Allocations to Convertible Bonds

• Reducing Allocations to Mega Cap Stocks

• Increasing Credit Exposure as Fixed Income Markets signaled recovery in the Second Quarter (through High Yield and Investment Grade ETF and Mutual Funds)

Convertible Bonds

As discussed above, Tech and Growth has largely outperformed cyclical and value stocks throughout the year. Specifically through 7/14 the Nasdaq Index returned 16.9% for 2020 while the more cyclical Dow Jones Industrial Average returned -6.6% for the year. With profit and revenue expectations for these companies growing rapidly we’ve looked for ways to increase our exposure to these areas, and made the decision to allocate to Convertible Bonds.

Convertible bonds offer holders the income of regular bonds and also an option to convert into shares of common stock of the same issuer at a pre-established price, even if the market price of the stock is higher. Convertible bond prices are influenced most by the current price—and the perceived prospects of the future price—of the underlying stock into which they are convertible. The trade-off for this asset class is usually lower yields than a traditional bond offers.

Mega Cap Stocks

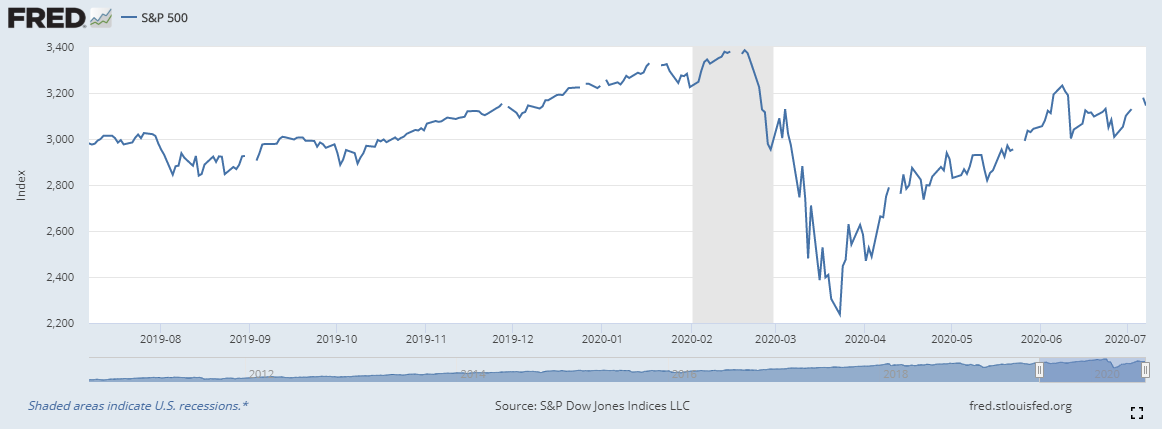

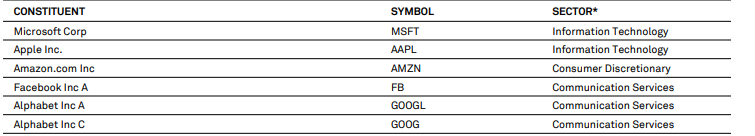

As the below chart details, the S&P 500 index, while under performing the Nasdaq, has regained the lion’s share of the draw-down suffered in the first quarter. In the short term, we believe it will be difficult for significant upside past the previous highs. Specifically this belief is driven by the increasing concentration of the index to “Mega Cap Growth” listed below as Microsoft, Apple, Amazon, Facebook, and Alphabet (Google).

These stocks have all rallied significantly and if they stall out could make it tough for the index to make significant gains. Alternately many of the smaller companies in the S&P 500 are still considerably off their highs with the S&P 500 equal weighted index down 10.9% through 7/14/2020. The five companies listed above make up about 21.7% of the Market Cap weighted S&P 500 as opposed to roughly 1.3% of the equal weighted index.

** Top 6 Positions in the S&P 500 Index (Source: S&P Dow Jones Indices)

Adding to Fixed Income Credit Exposures

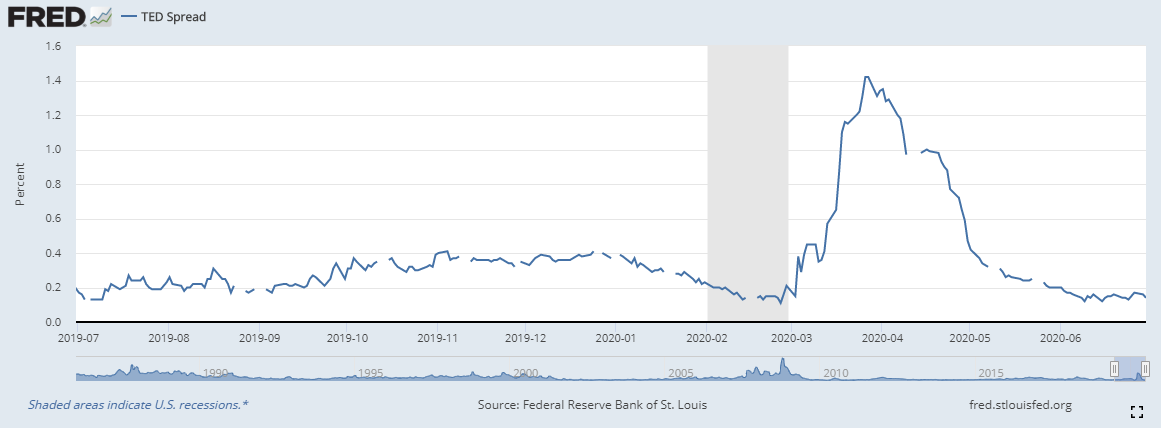

It is hard to overstate the breadth and impact of the Federal Reserve’s support of the Fixed Income Markets. During March, Credit Markets were completely locked up, which poses existential risk to the many US companies that rely on continued access to markets to fund their otherwise very solvent and profitable businesses. The Fed acted swiftly to restore liquidity and the last 90 days has seen record levels of issuance from US Companies.

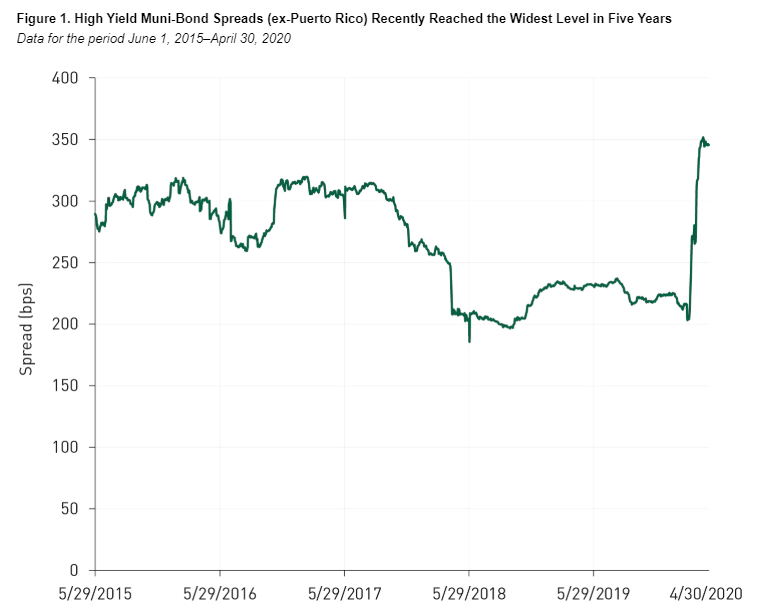

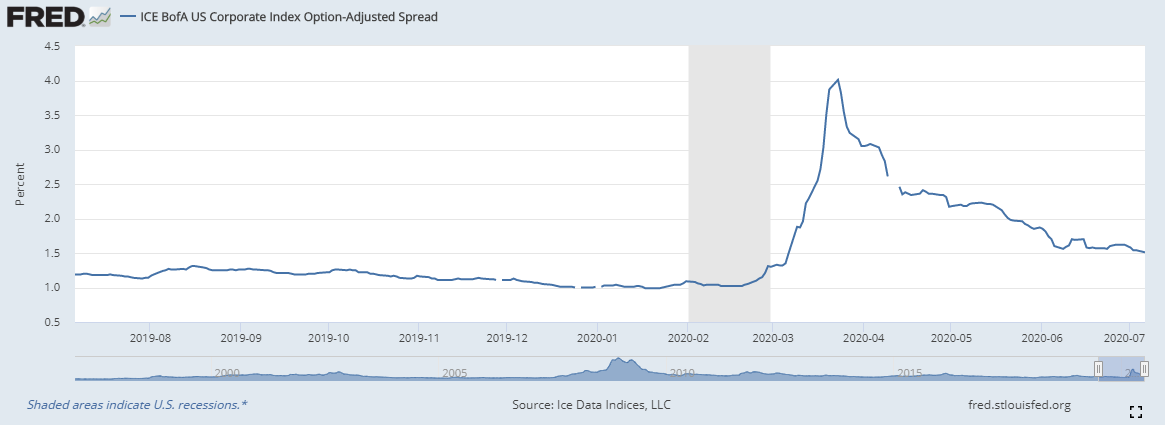

While the Fed action was swift, credit spreads – the amount in excess of the federal government that corporations and municipalities must pay in interest when issuing bonds — stayed stubbornly high in some markets through the second quarter and we seized this opportunity to invest at attractive yields. Despite spreads tightening through quarter-end, we think spreads are still attractive in some areas including High Yield Municipal Bonds as credit markets continue to stabilize. A few charts highlighting the disruption (increase in yields) of the first quarter are included below.

**bps or basis points is a Financial Markets measure of interest rates where 1.0% = 100bps

**TED Spread refers to the spread between Treasury Bills as “Euro Dollars” or Swap Rates. TED Spread is commonly used to measure stress in the banking system.

** The Chart above looks at the spread (defined above) of an index of corporate bonds above treasuries. The spread quoted is option adjusted to provide a fairer comparison to treasuries which carry no embedded options.

Bottom Line:

With the sharp recovery in markets, we have positioned portfolios to take advantage of continued opportunities in some areas while seeking to reduce downside risk in others. We believe the most likely path for the markets is bumpy with a return to the highs in the broader markets unlikely until a vaccine becomes widely available likely early in 2021.

The best investment strategy is highly personal, so if you’d like to discuss how any of these themes may impact your personal Financial Plan, please reach out!

July 2020

Content provided in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss. Investing involves risk including loss of principal. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Municipal bonds are subject to availability and change in price. They are subject to market

and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. If sold prior to maturity, capital gains tax could apply.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.