For the past 6 months or so, since the inflation “bug” has reared its ugly head, our team has been speaking regularly about the importance of inflation abating later in the year. Well, we are now later in the year. A great deal of data will be revealed in approximately 60 days from this writing of this newsletter. I urge you to take a moment to glance at the short list below and what we believe may be the implications of these dates.

-

Consumer Price Index Released on September 13 at 8:30 am

-

Federal Reserve decision on Interest Rates: 20-21

-

Consumer Price Index Released on October 13 at 8:30 am

-

Federal Reserve decision on Interest Rates: 1-2

-

Mid-Term Elections: November 8

-

Consumer Price Index Released on November 10 at 8:30 am

Our premise throughout the spring and summer has been we will begin to see “disinflation” in the latter part of the year and throughout next year. Disinflation is defined as inflation increasing albeit at a much slower rate. The July CPI release appears to be the peak in the inflation increases. August year over year numbers began to decline and now we are at the point of seeing just how effective the Federal Reserve has been in their policy to raise rates rather aggressively this year to tame inflation.

Implications from the Data?

Although the Fed was incorrect last year as they described inflation as “transitory”, they have been working to correct these policy mistakes. From the 1970’s ongoing inflationary environment, we have learned the Fed must stop inflation sooner rather than later. It took nearly a decade for the policy to catch up back in the 1970’s but Fed Chair Powell made it clear in his speech in Jackson Hole, Wyoming a couple of weeks ago, he is serious about this task.

If we see inflation moving down noticeably in the next 3 Fed announcements (dates listed above), it gives the Fed more room to begin to slow down the rate increases. The stock market as a whole is “looking for the sign” the Fed will begin to pivot in a more neutral policy. The CPI data will direct the Fed decisions and currently the market expectations are for a .75% increase on Sept. 21. The Fed then plans to skip October before setting rates in early November. As we move further out, the decision is more uncertain, however, further hikes are still expected.

The dates of the CPI release and the Fed meetings will be a critical path for the markets and the economy and if our “thesis” of disinflation later this year and 2023 is to be accurate, it is now or never for the data to improve.

Stay Away from Politics as much as possible

Now, to the all-important Mid Term elections on November 8th. If you have been a long time reader of my newsletter, you will note I stay out of politics and I plan to stay on that path, however, the upcoming elections play a role in the capital markets for sure.

“The most favorable outcome for markets would be a Republican win in both the House and the Senate,” says Jeremy Siegel, the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania. “If Republicans take the House and not the Senate, that would also be a relatively favorable outcome.”

The best returns, however, have come under Democratic presidents kept in check by a split or Republican Congress. “Historically, investors prefer shared power across the Federal government,” says RSM chief economist Joe Brusuelas. Based on historical data (CFRA Research, based on S&P 500 data from 12/31/44 – 12/31/21), the best environment for the equity markets is a “divided government”.

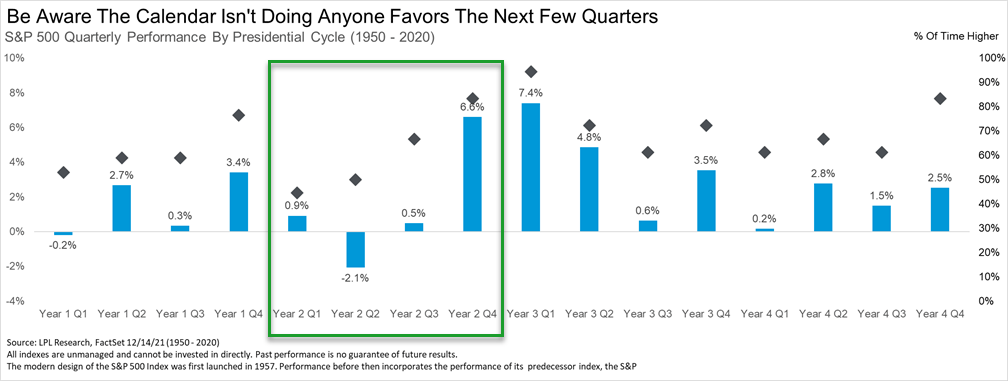

One final note on the calendar and the role it plays in the “seasonality” of the markets. When one observes the Presidential cycle as it relates to the performance overall, (according to LPL Research), the 4th quarter of the second year (or the midterm year) and 1st and 2nd quarter of the third year have traditionally been the best three quarters of the 16 total quarters of the cycle. Time will tell.

Wrapping this up, the next 60 days will go a long way in determining the path ahead for the markets. In my 27 years of work at Allen & Company, I have never asked a client to look at even the first CPI Release or pay much attention to any of the Federal Reserve Meetings, but there is always a first I suppose.

September 2022

Content in this material is for general information only and not intended to provide specifc advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss. Investing involves risk including loss of principal.