“The best time to plant a tree is 20 years ago. The second best time is now” – Chinese Proverb

What on earth do trees and stocks have to do with one another? The answer is more than you might think…

Trees are a great example of something that cannot be “rushed”. There is no quick solution to having large beautiful Oak or Pine trees all over one’s property. They can only be attained with care, planning and patience. The progress of tree growth can be painstakingly slow, however as the years pass by one day you look out your window and see a lush and beautiful canopy seemingly appearing from nowhere.

Investment Portfolios are likewise built over long-term periods of time. It’s highly unlikely that any singular trade or even any singular year will have an outsized impact on the collective success or size of one’s portfolio. Even those that may fund their retirement income portfolio through the sale of a business have usually dedicated decades if not generations nurturing the investment (business) that creates their portfolio. Those with a steady commitment to add to their portfolios throughout the years may well find themselves in awe of their portfolios’ growth decades later.

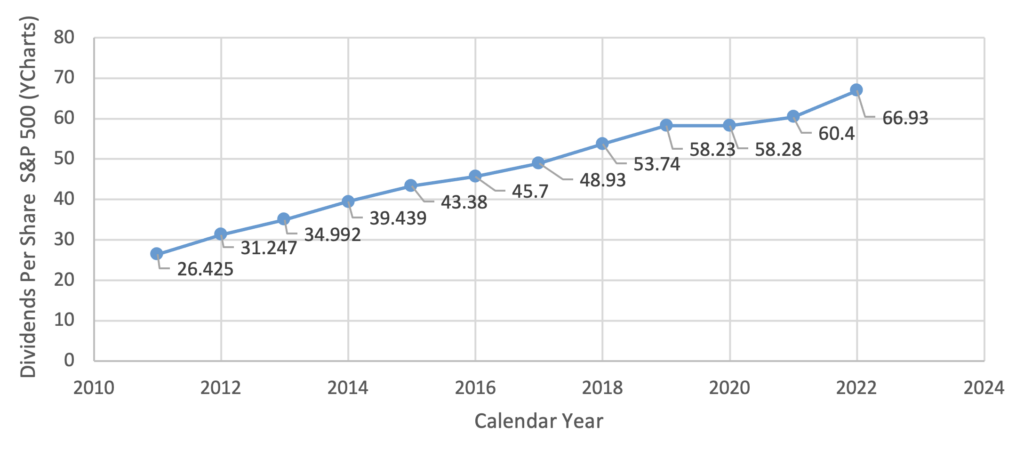

Extending this metaphor just a bit further, dividends and the dividend growth of an investment portfolio may be an even better example of this analogy. While stock market prices may see wide dispersions in results such as the great growth seen in a +27% return for the S&P 500 in 2021 (CNBC) or significant losses seen in a -19.44% return in 2022 (S&P Global), dividends historically have followed a remarkably stable path in comparison. Below, is a graph which outlines this reality by showing the change in dividends per share from the S&P 500 from 2011 – 2022 (YCharts).

The reason we are staunch believers in the value of dividend growth investing and employ it with many of our clients is because we feel like it is a sustainable foundation for success, and closely resembles the attributes we would look for if we were buying an entire business; rather than a small minority share of a large publicly traded company.

IF we were acquiring 100% ownership of a business we would likely look for the following:

- A balance sheet that is healthy with significantly more cash flow than the commitments necessary to service any debt.

- A history of growth, both in terms of overall sales and profits but of product market share as well.

- A long-term track record of navigating market cycles both through booms as well as lean times.

- A culture of quality capital allocation; treating shareholders as important

- A future business outlook that we determined could sustain the track record of profitability and sales

- A fair price for acquiring ownership.

All of these items are a part of the “screens”, both quantitative and qualitative, that we use when evaluating companies for our Dividend Growth Strategies. This “business owner mindset” brings a stable long-term view to our Dividend Strategies that we feel position us well to withstand periods of volatility like we’ve seen over the past year.

We are pleased our process has once again resulted in no portfolio companies reducing their dividends and a number of them reporting attractive increases. Finally, we are invigorated in our pursuit of identifying companies that can generate dividend growth for our clients in the decades to come… it is to this end that I and our entire Investment Committee work.

February 2023

Dividend payments are not guaranteed and may be reduced or eliminated at any time by any company.